Tremor Video Launches VideoHub in UK and Germany

Tremor Video is rolling out its in-stream video advertising analytics platform VideoHub in the UK and then Germany before tackling Asia. In the process, CEO Anthony Risicato says he want to engage agencies and publishers in conversations about video around marketing rather than about price alone.

VideoHub, which launched a year ago in the U.S., enables marketers and agencies to measure, verify, and analyse their video campaigns, regardless of how the media is bought or where the campaign runs. Brands and agencies will be able to license it for use with any ad server, ad network, and publisher.

“Tremor Video has been very successful over the last five years in building up the management and measurement tools for the campaigns we run,” explained Risicato. “Two years ago we decided that the next great leap was to take our technology and rollout the platform to clients, agencies, and publishers regardless whether then worked with our media team or not.

“A year ago we announced and launched VideoHub in the U.S. and it has achieved 8 billion video impressions to date. The solution is meant to do two things; to unite publishers and marketers in a very transparent way, to let each of those groups to see what is working and what is not in video advertising. And to acknowledge that video is fundamentally different to banner ads and search.

“Video is about brand health engagement and time spent with content. VideoHub is bringing those elements to the fore and allowing marketers to drive this in a meaningful way.”

VideoHub’s unnamed clients include “large groups of agency partners... we tend to focus on the large brands and large agency holding companies,” says Risciato. “We are trying to unite the TV buying world and the digital world and to help people on both sides realise that video is a marketing issue.”

Opportunity in the UK

He added that there are a lot of large brands who view the UK as an opportunity.

“The promise of the UK market is huge. We just need to drive dollars into the marketplace. The UK TV market is much more advanced than the U.S. [in terms of catch-up TV and online video services] and we think that this platform can help TV marketers understand digital from a brand specific perspective.”

It is a propitious time to launch, with Europe and the UK in particular on the verge of several major summer events which could see digital video demand skyrocket: the Diamond Jubilee in the first week of June, the UEFA Euro Championships in July, and the Olympics straddling July and August.

“The real reason we are launching is that we have completed the platform from a publishers and advertisers standpoint, so now I want to have a marketing conversation in the UK for video about marketing, not about what the cheapest price might be that I can buy media,” he said. “I want to talk about effectiveness of measurement. That is what happens when media becomes sophisticated. It begins with price but as it grows it become about effectiveness. That is the phase we are entering. We are often accused of being ahead of the curve... I am not solving the problem for the next quarter but for the long term.”

In partnership with Nielsen, VideoHub incorporates GRPs (gross ratings point) into its online video data. Available now in the U.S. and rolling out in the UK in Q2, this enables the reporting of GRP metrics, used by traditional TV advertising, to link in with its online video data.

“I don’t have a position on whether GPRS is right or wrong. I do believe it’s an important currency for marketers,” he said.

He declined to be drawn on whether Tremor would seek to work with the UK’s leading TV ratings body, BARB.

“We are interested in good data and how to bring that into our platform in a scalable way,” he said. “What we won’t do is find small point solutions that solve small problems for a particular campaign.”

ComScore results for March in the U.S. placed Tremor Video sixth with 676 million ads shown behind Hulu (1.8 billion), Google (1.3 billion), BrightRoll (953.2 million), Adap.tv (892.0 million), and Specific Media (775.5 million).

“In the U.S. we are the largest pure play video portal full stop,” he said. “We are the largest player in that space. [The ComScore measure] is a mediacentric view of the world with no bearing on our platform.

“We are here to enable publishers to measure video—they can know exactly what is driving campaign goals, including brand lift, brand engagement, and purchase intent as well as providing verification of where their ad is running.”

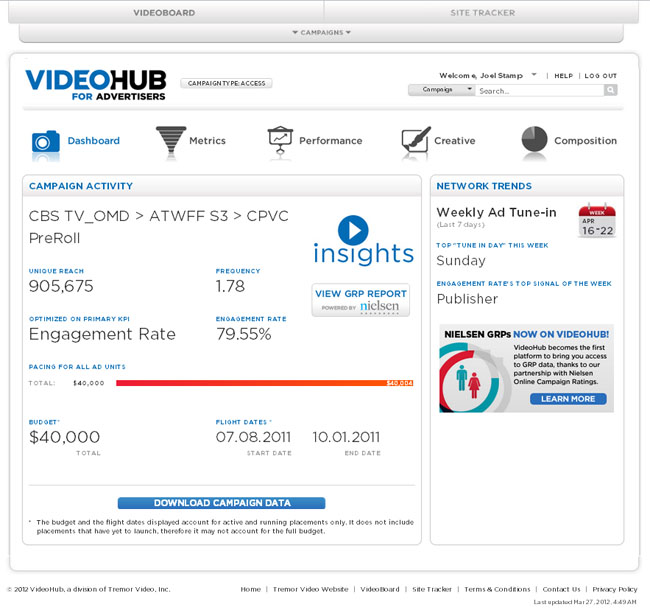

Tremor Video's VideoHub campaign data display

Measuring Video Advertising Impact

VideoHub tracks the impact of video advertising through measurable campaign data. The data (referred to as Signals) include content category, geo, time of day, day of week, video view history, frequency, demo, browser type, operating system and viewability, as well as where the ads run. This information is then scored against campaign goals including reach, frequency, time spent, brand lift, engagement, click-throughs and conversion, in real-time. This data, which is provided by the VideoHub dashboard, enables brands and agencies to optimize video advertising performance and reach.

While eyeballs are drifting to digital Risicato believes this will not damage the value of TV’s watercooler live events.

“I don’t think linear broadcast TV is at risk [from digital] because there still isn’t, and won’t be, a way for me to get millions of people sitting down at a specific time of day,” he said. “There is no other marketing vehicle like TV. But the harsh reality is that people are consuming more and more video online, often augmenting their TV experience with a second screen.”

Related Articles

While interest in online video advertising is strong, advertisers haven't yet embraced the medium.

13 Jun 2012